featuredProjects

Bulgaria

A unique investment opportunity to acquire A-4 Star hotel in Golden Sands

The hotel built in 2018, is a profitable business that provides a good range of facilities and a high standard of accommodation. The great location and the All Inclusive services make the hotel a perfect place for an unforgettable holiday.

The Hotel provides accommodation in 543 double standard, superior, double sea view and family rooms. The hotel consists of approximately 60 000 sqm built on 12 floors with three restaurants, two conference halls, outdoor swimming pool and a private beach area with sunbeds.

The Hotel is located in the central part of Golden Sands directly on the promenade in front of the beach and a 10-minute walk from Golden Sands Centre. Golden Sands is 13km from Varna and 37km from Varna airport.

Key Incentives investing in Bulgaria

- Bulgaria is in the European Union and easy access to EU markets

- Fast, easy and secure company formation

- 10% corporate tax

- 0% VAT for services in EU

- 5% dividend tax and 0% for EU/EEA legal entities

- Competitive labour costs

The company is open to discuss further with potential investors and buyers either to acquire 100% the property and business or to become an equity investor to the tune of 50% of the company which own the property and business.

For more information, please contact Ibrahim AYOUB

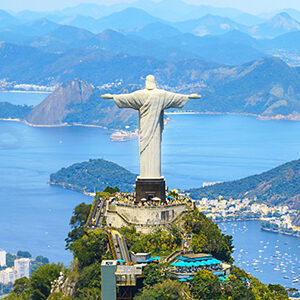

Saint Lucia

About the Group

Our client, the developer has more than 20 years of experience in developing, building and operating hospitality assets with eight existing 5-star branded hotels, sport complexes, real estate golf resort and hunting sites. Its existing hospitality and tourism related assets are worth approximately USD 300m. The group’s vision is to develop several more luxury branded hotels in strategic destinations within the next 10 years.

About the 5-star hotel development

The project is to develop, build and operate a 5-star luxury hotel consisting of 345 rooms on a land area of 156,244m² which is in a prime location and with direct access to the beach in the Caribbean Island of Saint Lucia. The total cost of the project is USD 154m and the client is bringing a cash equity of 30% (USD 46m) to the project and the client is looking to raise the balance amount of US$ 108m as a construction loan. The opening is scheduled during the first quarter of 2025.

| Return on equity | 217% over a 14 years period |

| Return on investment Payback | 65.31% |

| period | 11 years |

| IRR | 9.7% |

| Equity (levered) IRR | 12.50% |

| ADR | USD 339 |

| RevPar | USD 247 |

The company is open to discuss further with potential lenders and investors.

For more information, please contact Ibrahim AYOUB